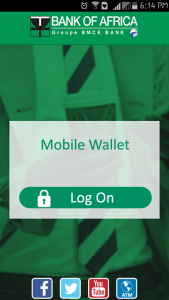

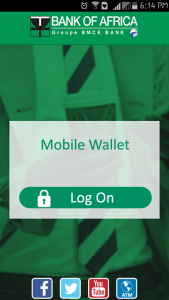

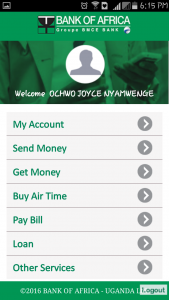

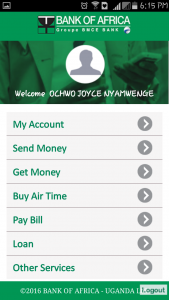

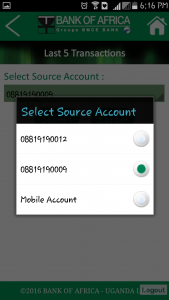

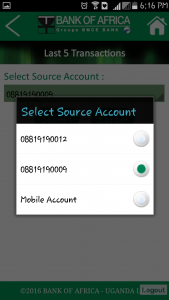

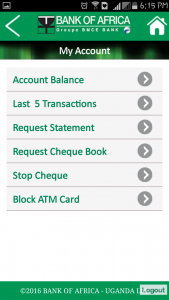

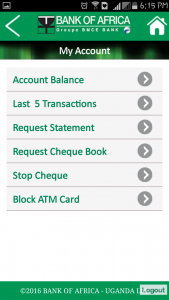

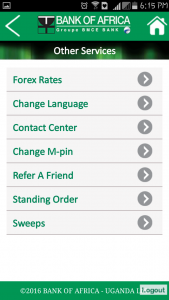

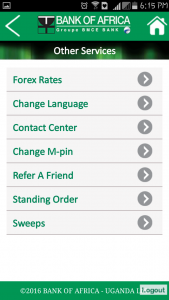

So I requested for the information that I needed to open my account from my in-house finance operations execution only to be informed that the agent would be coming to meet me to expedite the process since I was considered a VIP. Now, please note that I drive an old model Raum and live in a village called Buwate so I in no way consider myself a VIP. Below is the exchange that took place when he arrived at my location with an elaborate folio in hand. Agent: ‘’Hello, are you Madam Joyce?’’ Me: ‘’Yes I am, it is a pleasure to meet you.’’ Agent: ‘’The pleasure is mine. So I was informed that you needed to open an account with us.’’ Me: ‘’Yes, but I must be honest with you that I do not want to open an account with you so let’s just open one with the bare minimum balance required and requirements. I will also request you to give me forms to notify you to transfer 90% of my salary to my DFCU account when it hits my account.’’ Agent: ‘’Okay, but why don’t you let me know what your needs are so that I can give you options of what would suit you. If I do not find you something that works for all your needs then I will honour your wishes.’’ Me: ‘’Okay,’’ I replied with great hesitation but since my companion for my next meeting was late I decided to let him speak. Agent: ‘’ So what are your needs?’’ Me: ‘’I want to lose as little in bank charges, I do not want an ATM card, and I want to transfer money once a month to ICEA for my savings trust. DFCU, my current bank does not work with ICEA so I have to remember to send the money by Mobile money every month which defeats the purpose of saving using the trust in the first place.’’ Agent: ‘’You can do a transfer by EFT for the ICEA trust and I am happy to inform you that we are one of the banks that partners with them for this.’’ Me: ‘’So you can do this without me reminding you to send the money every month?’’ Agent: ‘’Yes we can.’’ Me: ‘’What about me saving on my account, I am not a 2 phone or 2 account kind of person. Is there anything that you have for a difficult person like me?’’ Agent: ‘’Yes, we can open a salary account for you and subdivide it so that there is a subsidiary saving account within it and you don’t have to go to the bank to divert to save on it from you primary account.’’ Me: ‘’ So, I can also sign an EFT for that as well for a year.’’ Agent: ‘’Yes and we will not charge you for that internal EFT because it is from one BOA account to another.’’ Me: ‘’Wow, so how many forms will I have to sign, when do I sign and how long will it take me to sign them to open an account?’’ Agent: ‘’You will have to sign an account opening form as well as Mobile wallet form, give me an I.D, opening balance of 20,000 as well as sign the standing order form for BOA – BOA and BOA – ICEA account for the saving trust. That’s 4 forms in total and I am happy to say that I have all 4 on me right now.’’ Me: ‘’Okay, that’s a lot to sort out.’’ Agent: ‘’No, just do the main form for opening and I will fill in all similar details for the other forms and you will have your account open by the end of day. This will also include your subsidiary BOA saving account.’’ In other words, I filled in forms for 15 – 20 minutes, the agent downloaded the BOA Mobile App and set it up for me and left to open my account. That was the last time I saw him and yet I could transact by that evening on my mobile wallet account, the entire platform is user friendly and caters to all my needs as can be seen in the image below. The only snag I have had is with my request for statement being processed from the Mobile wallet platform. I can request on the app but my branch never gets back to me on it so I had to call my agent to get a printout but I opted for an e-statement. For withdraw of funds, a customer needs to request for the specific account for withdraw, request for a pin and password for 1 time withdrawal. Now most of you must be wondering how secure this system is? Well, I can only use the login pin and password once and I must use them within 2 hours or else it becomes invalid. That’s great for me. Before I forget, I can also transact from my BOA mobile wallet and my Mobile account within seconds at any time of the day. As though this is not enough, I have also sent money using the BOA mobile wallet app to a friend’s account in Equity bank to help me pay for my online courses. I must inform you that this would have also been handled by my bank but for my laziness in applying for a visa card but the BOA – Equity transfer by EFT is more effective and occurs within 10-15 minutes unlike the RTGS which takes a maximum of 2 days but the latter is much cheaper. Therefore the latter is not for use in time sensitive situations. As though this is not enough, I have also sent money using the BOA mobile wallet app to a friend’s account in Equity bank to help me pay for my online courses. I must inform you that this would have also been handled by my bank but for my laziness in applying for a visa card but the BOA – Equity transfer by EFT is more effective and occurs within 10-15 minutes unlike the RTGS which takes a maximum of 2 days but the latter is much cheaper. Therefore the latter is not for use in time sensitive situations. I opened my BOA account 10 months ago and I have only been to the banking hall only once to withdraw over the counter when there was a technical glitch with the system. On the whole, I am having a wonderful experience with BOA and I am sorry to say I have not been back to DFCU to even close my account which I must do soon unless I find use for it. DFCU and I had a long standing relationship but did not respond to activating my mobile banking account even when I officially requested. The height of it all was when they lost my form the second time around when I registered for it.